Table of Contents

- 1 Understanding Quality of Earnings

- 2 Key Components of Quality of Earnings

- 3 Analyzing Financial Statements

- 4 Income Statement Analysis

- 5 Balance Sheet Examination

- 6 Cash Flow Statement Scrutiny

- 7 Identifying Red Flags in Earnings Quality

- 8 Unusual Revenue Recognition Practices

- 9 Aggressive Expense Capitalization

- 10 Non-Recurring Items and One-Time Events

- 11 Adjustments to Consider

- 12 Owner’s Compensation and Benefits

- 13 Related Party Transactions

- 14 Discretionary Expenses

- 15 Industry-Specific Considerations

- 16 Cyclical vs. Non-Cyclical Businesses

- 17 Regulatory Environment Impact

- 18 Due Diligence Process

- 19 Financial Due Diligence Checklist

- 20 Engaging Professional Assistance

- 21 Valuation Impact of Earnings Quality

- 22 Multiples and Their Relationship to Earnings Quality

- 23 Adjusting Valuation Based on Earnings Quality Assessment

- 24 Negotiation Strategies

- 25 Using Earnings Quality Findings in Price Negotiations

- 26 Structuring the Deal to Mitigate Risks

- 27 Post-Acquisition Considerations

- 28 Implementing Financial Controls

- 29 Monitoring and Improving Earnings Quality

- 30 Your Next Steps: Safeguarding Your Investment

- 31 Frequently Asked Questions

Understanding Quality of Earnings

Quality of earnings refers to the degree to which reported earnings reflect the true economic performance of a business. It’s about peeling back the layers of financial statements to reveal the underlying health and sustainability of a company’s profitability. Why is this so crucial? Well, imagine buying a car based solely on its shiny exterior, only to find out later that the engine is held together with duct tape and wishful thinking. That’s the risk you run when you neglect to assess the quality of earnings. High-quality earnings are typically characterized by:

- Consistency and predictability

- Accurate representation of cash flows

- Sustainable and recurring nature

- Transparency in reporting

On the flip side, low-quality earnings might be inflated by accounting gimmicks, one-time gains, or unsustainable practices. As a potential buyer, your goal is to distinguish between the two.

Key Components of Quality of Earnings

To truly understand the quality of earnings, you need to look at several key components:

- Revenue Recognition: How and when does the business record its sales?

- Expense Management: Are expenses properly categorized and timed?

- Cash Flow Correlation: Do earnings translate into actual cash?

- Accounting Policies: Are they conservative or aggressive?

- Non-Operating Items: How much of the earnings come from core business activities?

By examining these components, you’ll get a clearer picture of whether the business’s earnings are as solid as they appear on paper.

Analyzing Financial Statements

Now that we’ve covered the basics, let’s roll up our sleeves and dive into the financial statements. This is where the rubber meets the road in assessing earnings quality.

Income Statement Analysis

The income statement is your first stop on this financial detective journey. Here’s what to look for:

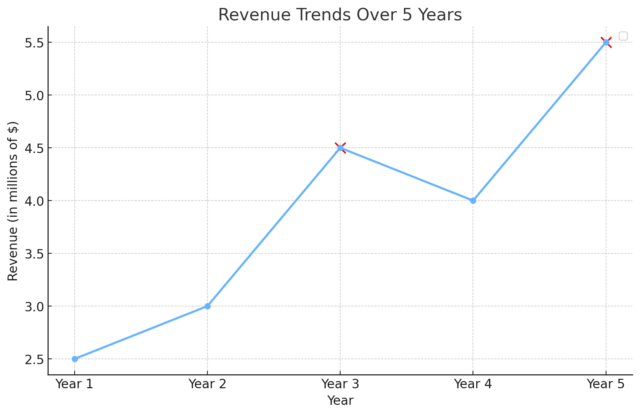

- Revenue Trends: Are sales growing steadily, or do you see erratic spikes?

- Gross Margin: Is it stable or fluctuating? Fluctuations could indicate pricing pressures or cost control issues.

- Operating Expenses: Look for any unusual patterns or sudden drops that seem too good to be true.

- Non-Operating Income: How much of the bottom line comes from one-time gains or losses?

Remember, consistency is key. A smooth, upward trend in revenues and earnings is generally a good sign, but don’t be fooled by a hockey stick growth curve that defies industry norms.

Balance Sheet Examination

The balance sheet provides a snapshot of the company’s financial position. Pay close attention to:

- Accounts Receivable: Is it growing faster than sales? This could indicate aggressive revenue recognition or collection problems.

- Inventory: Look for buildup that outpaces sales growth, which might suggest obsolescence issues.

- Debt Levels: High leverage can amplify earnings in good times but also magnify losses when things turn south.

- Working Capital: Is it sufficient to support the business’s operations?

A healthy balance sheet should show a good balance between assets, liabilities, and equity. Any significant changes or anomalies warrant further investigation.

Cash Flow Statement Scrutiny

If the income statement is the sizzle, the cash flow statement is the steak. It shows you where the money is actually flowing. Key areas to focus on include:

- Operating Cash Flow: This should closely track net income. If it doesn’t, find out why.

- Capital Expenditures: Are they sufficient to maintain the business’s competitive position?

- Free Cash Flow: This is what’s left after all the bills are paid and necessary investments are made. It’s often considered the truest measure of a company’s profitability.

Remember, cash is king. A business might report stellar earnings, but if it’s not generating cash, those earnings are about as useful as Monopoly money.

Identifying Red Flags in Earnings Quality

As you sift through the financial statements, keep your eyes peeled for warning signs that all may not be as it seems.

Unusual Revenue Recognition Practices

Be wary of:

- Channel stuffing (pushing inventory to distributors to inflate sales)

- Bill and hold arrangements (recording revenue before goods are shipped)

- Percentage of completion accounting that seems overly optimistic

These practices can make current earnings look great but often lead to future disappointments.

Aggressive Expense Capitalization

Some businesses try to boost earnings by capitalizing costs that should be expensed. This might include:

- Research and development costs

- Marketing expenses

- Routine maintenance

While there are legitimate reasons for capitalizing certain expenses, be skeptical of practices that deviate from industry norms.

Non-Recurring Items and One-Time Events

Watch out for:

- Frequent “restructuring” charges

- Gains from asset sales

- Insurance settlements

While these items aren’t necessarily red flags on their own, they can distort the true earnings picture if not properly accounted for.

Adjustments to Consider

When assessing the quality of earnings, you’ll often need to make adjustments to get a clearer picture of the business’s true earning power.

Owner’s Compensation and Benefits

In small businesses, owners often pay themselves above or below market rates. You’ll need to normalize these expenses to reflect what you’d expect to pay a non-owner manager.

Related Party Transactions

Keep an eye out for dealings with entities controlled by the owner or their family members. These transactions might not be at arm’s length and could distort profitability.

Discretionary Expenses

Expenses like travel, entertainment, and vehicle costs can often be inflated in small businesses. You’ll want to adjust these to reflect what’s truly necessary for the business’s operations.

Industry-Specific Considerations

Every industry has its quirks, and understanding these is crucial for assessing earnings quality.

Cyclical vs. Non-Cyclical Businesses

If you’re looking at a cyclical business, like construction or luxury goods, be sure to consider where we are in the economic cycle. Earnings at the peak of a cycle might not be sustainable.

Regulatory Environment Impact

Some industries are heavily regulated, which can affect earnings quality. For example, changes in healthcare regulations can have a significant impact on medical practices or healthcare technology companies.

Due Diligence Process

Now that you know what to look for, let’s talk about how to go about your investigation.

Financial Due Diligence Checklist

Here’s a quick checklist to guide your due diligence:

- Review 3-5 years of financial statements

- Analyze key ratios and trends

- Scrutinize accounting policies

- Examine major contracts and commitments

- Review tax returns and assess tax risks

- Investigate customer and supplier relationships

- Assess the quality of assets

- Review internal controls and financial reporting processes

Engaging Professional Assistance

While you can certainly do much of this analysis yourself, don’t hesitate to bring in the pros. A good accountant or financial advisor can provide invaluable insights and help you spot issues you might miss.

Valuation Impact of Earnings Quality

The quality of earnings doesn’t just affect the sustainability of the business – it directly impacts its value.

Multiples and Their Relationship to Earnings Quality

Businesses with high-quality earnings typically command higher valuation multiples. Why? Because buyers are willing to pay a premium for predictable, sustainable earnings.

Adjusting Valuation Based on Earnings Quality Assessment

Once you’ve assessed the quality of earnings, you may need to adjust your valuation. This might involve:

- Normalizing earnings for non-recurring items

- Applying a lower multiple to reflect higher risk

- Using a weighted average of historical earnings instead of just the most recent year

Remember, the goal is to arrive at a valuation that reflects the true earning power of the business.

Negotiation Strategies

Armed with your earnings quality assessment, you’re now in a strong position to negotiate.

Using Earnings Quality Findings in Price Negotiations

If you’ve uncovered issues with earnings quality, don’t be afraid to use this information to negotiate a better price. Be prepared to explain your findings and how they affect your valuation of the business.

Structuring the Deal to Mitigate Risks

Consider structuring the deal to protect yourself from earnings quality issues. This might include:

- Earnouts based on future performance

- Holdbacks or escrow arrangements

- Representations and warranties from the seller

The key is to align the purchase price with the actual performance of the business post-acquisition.

Post-Acquisition Considerations

Your work doesn’t end once the deal is done. To maintain and improve earnings quality, you’ll need to stay vigilant.

Implementing Financial Controls

Once you take over, prioritize implementing robust financial controls. This might include:

- Upgrading accounting systems

- Implementing stricter approval processes for expenses

- Improving inventory management

Monitoring and Improving Earnings Quality

Regularly review financial statements and key performance indicators to ensure the business is performing as expected. Look for opportunities to improve earnings quality by:

- Streamlining operations

- Diversifying customer base

- Implementing more conservative accounting practices

Your Next Steps: Safeguarding Your Investment

As we wrap up this comprehensive guide on quality of earnings, I hope you’ve gained valuable insights into this crucial aspect of buying a small business. Remember, the journey we’ve outlined here – from understanding financial statements to identifying red flags and assessing sustainable earnings – is not just an academic exercise. It’s a vital process that can make the difference between a successful acquisition and a costly mistake. Now, you might be feeling a bit overwhelmed. After all, evaluating the quality of earnings is a complex task that requires both financial acumen and industry-specific knowledge. But don’t let that deter you from pursuing your entrepreneurial dreams. Instead, consider this complexity as a call to action. My advice? Don’t go it alone. Hiring a professional to assist with your due diligence process is one of the smartest investments you can make. For just a fraction of the purchase price – typically 1% to 3% – you can engage experts who can:

- Conduct a thorough quality of earnings analysis

- Identify potential risks and opportunities that you might overlook

- Provide an objective valuation of the business

- Help you negotiate better terms based on their findings

Think about it this way: would you rather spend a small percentage upfront to ensure you’re making a sound investment, or risk overpaying for a business with hidden financial issues? The cost of professional assistance pales in comparison to the potential losses from a bad acquisition. Remember, you’re not just buying a business; you’re investing in your future. By prioritizing the quality of earnings in your evaluation and seeking expert help, you’re setting yourself up for long-term success. So take that crucial next step – reach out to a qualified financial advisor or business valuation expert. It could be the best decision you make in your entrepreneurial journey. Your dream of owning a successful small business is within reach. Armed with the knowledge from this guide and the support of professionals, you’re well-equipped to navigate the complexities of assessing earnings quality. Here’s to making informed decisions and building a thriving business!

Frequently Asked Questions

- What’s the difference between earnings quality and earnings management?

Earnings quality refers to the overall reliability and sustainability of a company’s reported earnings, while earnings management involves manipulating financial reporting to present a desired picture of financial performance. - How can I spot aggressive revenue recognition practices?

Look for sudden spikes in revenue, especially near the end of reporting periods, growing accounts receivable that outpace sales growth, and complex contracts with multiple elements. - Is it always bad if a company has low-quality earnings?

Not necessarily. Some businesses naturally have more volatile earnings due to their industry or business model. The key is understanding the reasons behind the low quality and assessing whether they’re likely to improve. - Should I walk away from a deal if I find issues with earnings quality?

Not always. Issues with earnings quality can often be addressed through price negotiations or deal structuring. However, if the problems are severe or indicate fraudulent behavior, walking away might be the best option. - How often should I reassess earnings quality after acquiring a business?

It’s a good practice to review earnings quality quarterly, with a more in-depth analysis annually. This allows you to spot trends and address issues before they become significant problems.