Disclaimer: This article is for informational purposes only and does not constitute legal advice. As a search funder or anyone involved in a business acquisition, you should always consult with a qualified attorney for specific guidance.

If you’re a search funder looking to buy a small business, understanding how to structure the deal is crucial. This guide will walk you through the basics of deal structuring, helping you make informed decisions when the time comes to make an offer.

Table of Contents

- 1 How to Structure a Small Business Acquisition? Asset Purchase Agreement vs. Stock Purchase Agreement

- 2 The Importance of Quality of Earnings in Acquisitions

- 3 How to Choose Between Asset and Stock Purchase

- 4 Practical Steps in Structuring a Small Business Acquisition Deal

- 5 Common Pitfalls to Avoid

- 6 Practical Tips for Negotiation

- 7 Conclusion

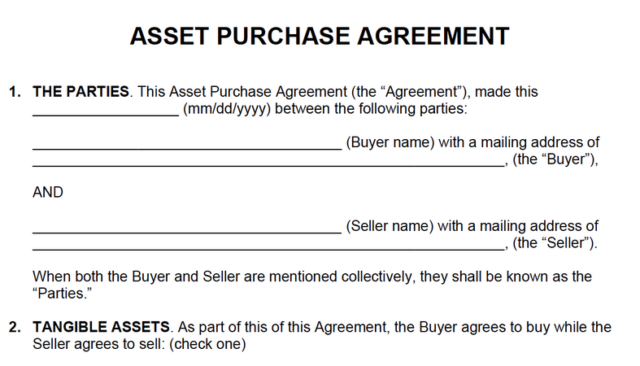

How to Structure a Small Business Acquisition? Asset Purchase Agreement vs. Stock Purchase Agreement

When structuring a small business acquisition deal, you’ll typically choose between two main options: an asset purchase or a stock purchase. Let’s break these down in simple terms.

Asset Purchase Agreement:

In an asset purchase, you’re buying specific parts of the business, not the entire company. Think of it like buying items from a store rather than buying the whole store.

Pros:

- You can pick and choose what you want to buy

- You might pay less in taxes

- You’re less likely to inherit unknown problems

Cons:

- It can be more complicated because you have to transfer each asset

- The seller might pay more in taxes, which could affect the price they’re willing to accept

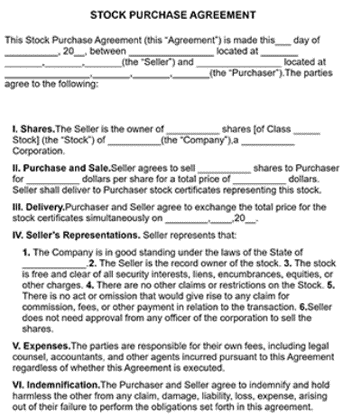

Stock Purchase Agreement:

In a stock purchase, you’re buying the entire company, including all its assets and debts. It’s like buying the whole store, inventory, staff, and all. Pros:

- It’s usually simpler because you’re buying everything at once

- The seller might pay less in taxes, which could make them more willing to sell

Cons:

- You inherit all the company’s problems, even ones you don’t know about yet

- You might not be able to deduct as much on your taxes

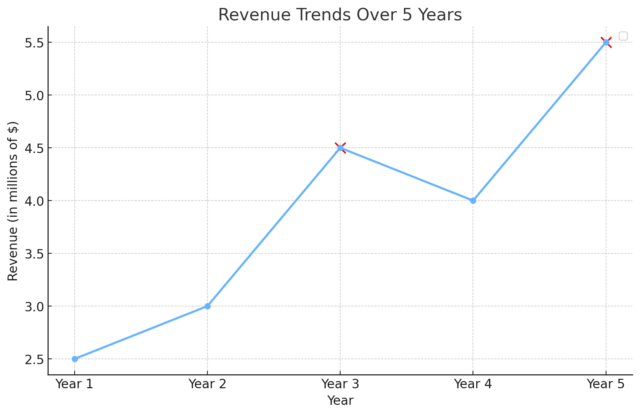

The Importance of Quality of Earnings in Acquisitions

When structuring a small business acquisition deal, one crucial aspect that often gets overlooked is the quality of earnings. Quality of earnings refers to the sustainability and accuracy of a company’s reported earnings. It’s not just about how much money the business makes, but how reliable and consistent those earnings are. A quality of earnings analysis digs deep into the company’s financial statements, looking for things like:

- Non-recurring income or expenses

- Changes in accounting methods

- Unusual or one-time transactions

- The sustainability of current revenue streams

Understanding the quality of earnings is vital because it helps you:

- Determine the true value of the business

- Identify potential risks or red flags

- Make more accurate projections for future performance

- Negotiate a fair price based on reliable financial information

As a search funder, investing in a quality of earnings report can save you from overpaying for a business or taking on unexpected financial risks. It’s an essential tool in your due diligence toolkit.

How to Choose Between Asset and Stock Purchase

When structuring a small business acquisition deal, consider these factors:

- What’s included: Make a list of what you want to buy. If you only want certain parts of the business, an asset purchase might be better.

- Liabilities: Are there any lawsuits or debts you’re worried about? An asset purchase can help you avoid taking these on.

- Taxes: Talk to an accountant about which option will save you more on taxes. This can make a big difference in the long run.

- Simplicity: If you want to keep things simple, a stock purchase is usually easier to execute.

- Contracts: Check if the business has important contracts that can’t be transferred in an asset sale. If so, a stock purchase might be necessary.

Practical Steps in Structuring a Small Business Acquisition Deal

- Do Your Homework:

Before you start structuring a deal, learn everything you can about the business. Look at their financial statements, customer lists, and contracts. This is called due diligence, and it’s crucial for making informed decisions. - Decide What to Buy:

Make a list of what you want to include in the deal. This might be equipment, inventory, customer relationships, or intellectual property. Be specific about what you do and don’t want. - Figure Out the Price:

Determine how much you’re willing to pay. This should be based on the business’s financials and your future plans. Remember, the structure of the deal can affect the price. - Consider How You’ll Pay:

Will you pay all cash? Use a bank loan? Ask the seller to finance part of it? Each option has pros and cons, so think carefully about what works best for you. - Draft a Letter of Intent (LOI):

This is a document that outlines the basic terms of your offer. It should include:- The price you’re offering

- What’s included in the sale

- How you’ll pay (cash, loan, seller financing)

- Any major conditions (like being able to get a loan)

- Whether it’s an asset or stock purchase

- Negotiate:

Be prepared to discuss the terms with the seller. They might want to change some things. Be open to compromise, but know your limits. - Get It in Writing:

Once you agree on the terms, you’ll need a formal purchase agreement. This is a legal document that spells out all the details of the deal.

Common Pitfalls to Avoid

When structuring a small business acquisition deal, watch out for these common mistakes:

- Overlooking liabilities: Make sure you understand all the debts and potential lawsuits the business might have.

- Ignoring tax implications: The deal structure can greatly affect your taxes. Always consult with a tax professional.

- Forgetting about employees: Think about what will happen to the current employees. Will you keep them? Do they have contracts?

- Not planning for the transition: Consider how you’ll take over the business. Will the current owner help you? For how long?

- Rushing the process: Take your time to understand everything. It’s better to go slow and get it right than to rush and make mistakes.

Practical Tips for Negotiation

- Know your numbers: Understand the business’s financials inside and out. This will help you negotiate effectively.

- Be clear about what you want: Make a list of your “must-haves” and “nice-to-haves.”

- Listen to the seller: Understanding their motivations can help you structure a deal that works for both of you.

- Be prepared to walk away: If the deal doesn’t make sense, don’t be afraid to say no.

- Get everything in writing: Even small agreements should be documented to avoid misunderstandings later.

Conclusion

Structuring a small business acquisition deal doesn’t have to be overwhelming. By understanding the basics of asset vs. stock purchases, doing thorough due diligence, and carefully considering all aspects of the deal, you can set yourself up for a successful acquisition. Remember, every deal is unique. What works for one business might not work for another. That’s why it’s crucial to work with experienced professionals who can guide you through the process.

Are you ready to take the next step in your search fund journey? Contact Centsiq today to learn how our Quality of Earnings services can support your search fund efforts and help you secure a successful acquisition.