Starting a Therapy Practice and Unsure About the Best Accounting Software for Small Businesses? Here’s a Stress-Free Guide to Choosing the Right One

Starting a new therapy practice can be incredibly rewarding, but there’s no denying that it also brings its own set of challenges. Suddenly, it’s not just about connecting with clients and providing quality therapy—you also have to navigate the world of business, accounting, and bookkeeping. One of the questions I see often is about which accounting or bookkeeping software is best for a small, budding therapy practice.

Imagine this: you’re setting up your very first office, perhaps turning an empty room into a cozy, inviting space for your clients. You’ve got your paperwork in order, but now it’s time to manage your finances. Where do you start?

That’s exactly where one practitioner’s wife found herself recently. Starting her first business, she was a little overwhelmed when it came to choosing accounting software. She wasn’t particularly tech-savvy, and there were just too many options out there. Sound familiar? If so, you’re in the right place. Let’s dive into what kind of bookkeeping solutions work best for small practices, and how to make these decisions without losing sleep over numbers.

Table of Contents

The Different Paths for Managing Your Therapy Practice Finances

The question about bookkeeping software might seem simple, but the answer can vary significantly based on your circumstances. There are multiple ways to approach this, depending on what stage your practice is at, and how much time or money you’re willing to invest. Let’s break down a few of the options:

1. Accounting Software for Small Businesses Free: Using Spreadsheets (Excel or Google Sheets)

If you’re just starting out, you might not want to jump right into purchasing expensive software. For small businesses with a relatively low number of transactions, spreadsheets can do the trick. So is Excel an accounting software? The answer is yes.

- Why It Works for Small Practices: Spreadsheets are inexpensive (often free) and highly customizable. With some basic knowledge, you can set up a system to track income, expenses, and cash flow.

- Drawbacks to Consider: This option does require some manual work. You’ll need to enter each transaction and do the calculations yourself (or with formulas). It’s not difficult, but it can be time-consuming. Also, if you’re not familiar with Excel, there’s a learning curve. Consider asking yourself: “Is spending time on bookkeeping the best use of my time?”

2. DIY with a Boost: QuickBooks or Similar Software

For those looking for a bit more automation, software like QuickBooks offers a great middle ground between doing everything manually and hiring professional help.

- Why It Works: QuickBooks (or alternatives like Xero and Wave) can streamline the entire process. They are designed to simplify bookkeeping tasks, like tracking expenses, creating invoices, and generating basic financial reports. This is particularly helpful if you’re managing a small but growing practice and want to stay on top of things without a deep dive into accounting.

- Ease of Use: QuickBooks has made strides in being beginner-friendly, but there’s still a need to get used to some accounting language and functions. If you aren’t comfortable with learning new tech tools, it might take a bit of time to get up to speed. However, many therapists find that after the initial learning phase, it saves hours compared to manual tracking.

3. Hire Someone Per Hour or Use a Bookkeeper for Bookkeeping

If managing the numbers yourself feels overwhelming, there’s no harm in bringing in professional help. Hiring a bookkeeper can take the entire burden off your shoulders.

- Why It Works: This option is ideal for those who simply don’t want to deal with bookkeeping. Professionals can handle the tedious work, allowing you to focus on your clients and grow your practice. For many therapists, this is the tipping point—hiring help allows them to see more clients, which more than makes up for the cost of hiring someone.

- Cost-Benefit Analysis: Ask yourself: “If I spend three hours a week doing bookkeeping, could I use that time to see clients instead?” If so, the income from those extra sessions might outweigh the cost of hiring someone.

Time Management and Opportunity Cost

One of the most valuable pieces of advice shared was the importance of evaluating how you spend your time. As a therapist, your primary income comes from client sessions.

Therefore, it’s crucial to ask yourself: “Is the time I’m spending on administrative tasks like bookkeeping, marketing, or website management worth more than the income I could generate by seeing clients during that time?”

This concept of opportunity cost is vital in decision-making. For instance, if you spend 10 hours a month on bookkeeping, and your hourly rate for therapy sessions is $100, you’re essentially “spending” $1,000 worth of potential income on bookkeeping. In this case, hiring a bookkeeper for $500 a month could actually result in a net gain of $500 if you use that time to see more clients.

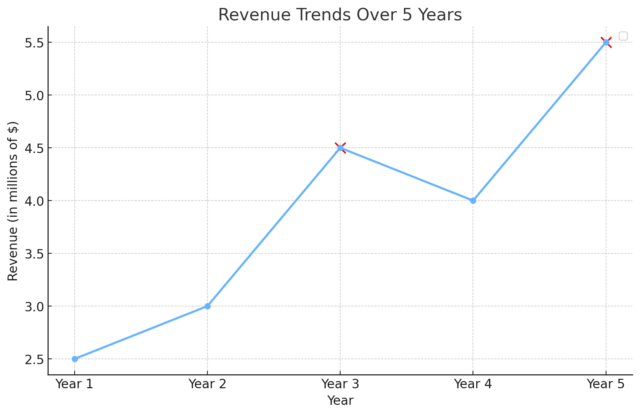

Growth Potential: Beyond Solo Practice

Now, let’s talk about the future. For those who want to keep their practice small—perhaps just you in a cozy office—keeping bookkeeping simple might be all you need. But if you’re thinking about growing, maybe expanding into a group practice or even multiple locations, then investing early in scalable systems will make your life easier down the road.

- Scalable Solutions: If you plan to grow, you might want to consider software that can scale with you. QuickBooks Online and Xero both offer features like payroll, multiple users, and integrations with other business tools (like appointment scheduling software), which become invaluable when you add employees or partners.

- Personal Experience: One business owner shared that their revenue grew from relatively small beginnings to millions by always considering the small day-to-day decisions that would allow them to focus more on clients and expansion rather than getting bogged down by administration. They leveraged software and outsourced tasks as soon as it made financial sense.

Lazy, But Efficient: Finding Your Own Balance

One of the more entertaining responses to the original question came from a therapist who described themselves as “pretty damn lazy.” After working hard to grow their practice, they now see only a few clients per week and enjoy having their time back. The key lesson here? Efficiency isn’t about working more, it’s about working smarter.

It’s okay to admit that you don’t want to spend every spare minute on administrative tasks. If the goal is to spend more time with your family, enjoy hobbies, or simply take a breather, then outsourcing tasks like bookkeeping is a wise decision. In the end, the choice comes down to what you value most: your time, your money, or your peace of mind.

Final Thoughts: Which Solution is Right for Your Therapy Practice?

Ultimately, there’s no one-size-fits-all answer to choosing bookkeeping software for your therapy practice. It depends on:

- Your Budget: Do you have funds available for software or a bookkeeper? Or do you need to save costs upfront?

- Your Time: Is your time better spent with clients, growing your practice, or managing finances?

- Your Future Goals: Are you planning to stay small, or are you hoping to grow?

For those just getting started, consider spreadsheets to get a feel for your income and expenses. If things start to feel too manual, step up to software like QuickBooks for automation. And when the time comes, don’t hesitate to hire someone who can do it better and faster than you—freeing you up to focus on what matters most.