When you’re considering a small business acquisition, you might wonder if a Quality of Earnings (QoE) report is always necessary. As an expert in quality of earnings for small business acquisition, I’m here to guide you through the process and help you understand when alternatives to QoE for small companies might be appropriate.

In this comprehensive guide, we’ll explore simplified QoE for business buyers, delve into DIY quality of earnings analysis, and discuss when to skip QoE in business acquisition.

Table of Contents

- 1 Understanding Quality of Earnings (QoE)

- 2 Why QoE Matters

- 3 When to Consider Alternatives to QoE for Small Companies

- 4 DIY Quality of Earnings Analysis: A Step-by-Step Guide

- 4.1 Step 1: Gather Financial Documents

- 4.2 Step 2: Compare Financial Statements

- 4.3 Step 3: Analyze Revenue Trends

- 4.4 Step 4: Review Expense Categories

- 4.5 Step 5: Assess Profit Margins

- 4.6 Step 6: Examine Cash Flow

- 4.7 Step 7: Analyze Working Capital

- 4.8 Step 8: Identify Non-Recurring Items

- 4.9 Step 9: Consider Owner’s Compensation

- 4.10 Step 10: Document Your Findings

- 5 Simplified QoE for Business Buyers: Key Focus Areas

- 6 When to Skip QoE in Business Acquisition: Red Flags

- 7 Practical Tips for Simplified QoE for Business Buyers

- 8 Case Study: When Skipping QoE in Business Acquisition Worked

- 9 Conclusion: Balancing Diligence and Efficiency

- 10 More Resources

Understanding Quality of Earnings (QoE)

Before we explore alternatives to QoE for small companies, let’s understand what a QoE report entails. A quality of earnings for small business acquisition report is a detailed financial analysis typically performed during due diligence. Its primary purpose is to validate the target company’s financial statements and provide an in-depth look at the sustainability of reported earnings.

Why QoE Matters

Quality of earnings for small business acquisition is crucial because it helps buyers:

- Identify potential financial risks

- Understand the true profitability of the business

- Uncover any accounting irregularities

- Assess the sustainability of earnings

However, while QoE reports are valuable, they can be expensive and time-consuming, especially for smaller transactions. This is where alternatives to QoE for small companies come into play.

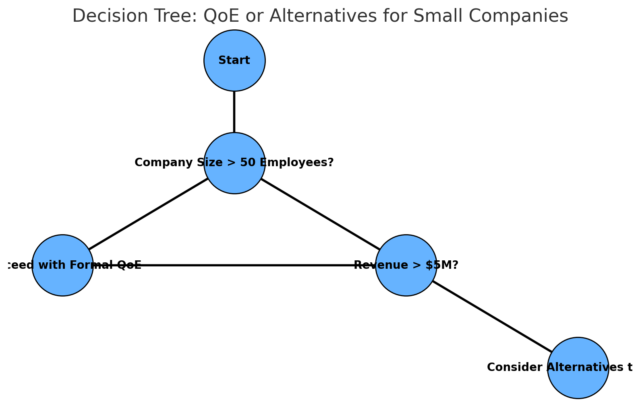

When to Consider Alternatives to QoE for Small Companies

There are several scenarios where you might consider simplified QoE for business buyers or even skip the formal QoE process:

- Small Transaction Size: For deals under $2 million, a full quality of earnings for small business acquisition might be overkill.

- Straightforward Financials: If the target company has simple, easy-to-understand financial statements, you might not need a comprehensive QoE.

- Limited Resources: When time or budget constraints make a full quality of earnings for small business acquisition impractical.

- Seller Transparency: If the seller is highly cooperative and provides detailed financial information upfront.

- Industry Knowledge: When you have extensive experience in the industry and can easily spot red flags.

In these cases, you might opt for DIY quality of earnings analysis or other simplified approaches.

DIY Quality of Earnings Analysis: A Step-by-Step Guide

If you decide to skip a formal QoE, you can still perform a simplified analysis on your own. Here’s how to conduct a DIY quality of earnings analysis:

Step 1: Gather Financial Documents

Request the following documents from the seller:

- 3-5 years of tax returns

- Profit and Loss (P&L) statements

- Balance sheets

- Bank statements

- Accounts receivable and payable aging reports

Step 2: Compare Financial Statements

Cross-reference the P&L statements with the tax returns. Look for any discrepancies between the two. If they match closely, it’s a good sign of financial accuracy.

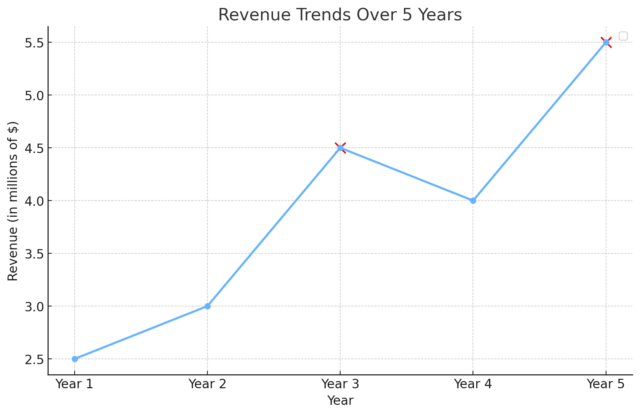

Step 3: Analyze Revenue Trends

Examine the revenue trends over the past few years. Look for:

- Consistent growth or decline

- Seasonal patterns

- Unusual spikes or drops

Step 4: Review Expense Categories

Analyze major expense categories:

- Are they consistent with industry norms?

- Are there any unusual or one-time expenses?

- Have any significant costs been omitted?

Step 5: Assess Profit Margins

Calculate gross and net profit margins for each year. Compare these to industry benchmarks to see how the business stacks up.

Step 6: Examine Cash Flow

Review bank statements and compare them to the P&L:

- Do deposits match reported revenue?

- Are there any large, unexplained transactions?

- Is the business consistently cash flow positive?

Step 7: Analyze Working Capital

Look at accounts receivable and payable:

- Are there any old, potentially uncollectible receivables?

- Is the business paying its bills on time?

- Is there a healthy balance between receivables and payables?

Step 8: Identify Non-Recurring Items

Spot any one-time revenues or expenses that might skew the financial picture:

- Large equipment sales

- Legal settlements

- Extraordinary repairs or renovations

Step 9: Consider Owner’s Compensation

Assess the owner’s salary and benefits:

- Is it in line with market rates?

- Are there any personal expenses run through the business?

Step 10: Document Your Findings

Compile your observations and any questions that arise during your DIY quality of earnings analysis. This will form the basis of your simplified QoE report. By following these steps, you can perform a basic quality of earnings for small business acquisition without the need for a formal QoE report.

Simplified QoE for Business Buyers: Key Focus Areas

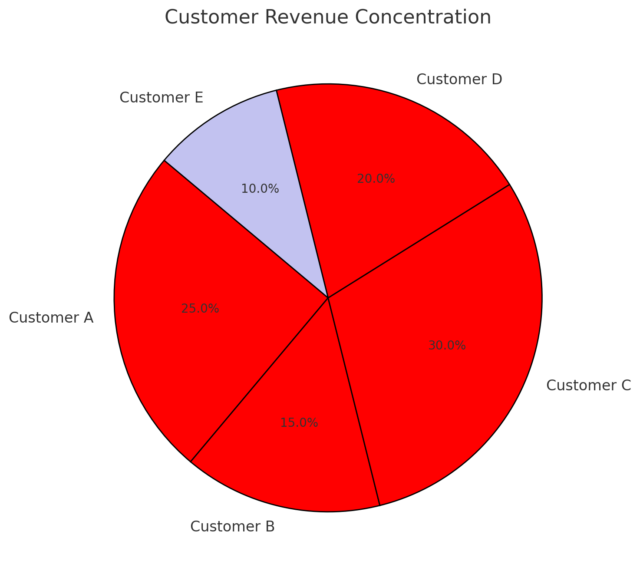

When conducting a simplified QoE for business buyers, focus on these critical areas:

- Revenue Verification: This is perhaps the most crucial aspect. Ensure that reported revenue aligns with bank deposits and tax returns.

- Expense Rationalization: Look for any expenses that seem out of place or could be reduced under new ownership.

- EBITDA Calculation: Calculate Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) to get a clear picture of the business’s operational performance.

- Working Capital Analysis: Assess the business’s ability to meet short-term obligations and fund operations.

- Customer Concentration: Identify if the business relies heavily on a few key customers, which could pose a risk.

When to Skip QoE in Business Acquisition: Red Flags

While alternatives to QoE for small companies can be effective, there are situations where you should not skip a formal quality of earnings for small business acquisition:

- Complex Financial Structure: If the business has multiple entities or complicated accounting practices, a professional QoE is advisable.

- Significant Growth or Decline: Rapid changes in financial performance warrant a closer look by experts.

- Industry-Specific Complexities: Some industries have unique accounting practices that require specialized knowledge.

- Large Transaction Size: For deals over $5 million, the investment in a formal QoE is usually justified.

- Inconsistent Financial Records: If you spot major discrepancies in your initial review, it’s time to call in the professionals.

Practical Tips for Simplified QoE for Business Buyers

When performing a DIY quality of earnings analysis or using simplified QoE for business buyers, keep these tips in mind:

- Use Technology: Leverage accounting software to help analyze financial data more efficiently.

- Seek Expert Advice: Even if you’re not commissioning a full QoE, consider consulting with an accountant or financial advisor for specific questions.

- Focus on Cash: As the saying goes, “Cash is king.” Pay special attention to cash flow patterns and discrepancies.

- Look Beyond the Numbers: Consider qualitative factors like customer relationships, market position, and growth potential.

- Document Everything: Keep detailed notes of your analysis process and findings. This will be valuable if you need to justify your decisions later.

Case Study: When Skipping QoE in Business Acquisition Worked

Let’s look at a real-world example of when skipping a formal QoE in favor of alternatives to QoE for small companies was successful: John was looking to acquire a small hydraulic repair and service company with annual revenue of $1.7 million. The seller provided three years of tax returns, P&L statements, and bank records. John, who had experience in the industry, decided to perform a simplified QoE for business buyers himself. He found that:

- The tax returns matched the P&L statements closely

- Revenue showed steady 5% year-over-year growth

- Expenses were in line with industry standards

- Bank deposits correlated well with reported revenue

Based on this DIY quality of earnings analysis, John felt comfortable proceeding without a formal QoE. He was able to complete the acquisition successfully, saving time and money in the process. Illustration suggestion: A side-by-side comparison of the company’s reported financials and John’s simplified QoE findings.

Conclusion: Balancing Diligence and Efficiency

In the world of small business acquisitions, knowing when to skip QoE in business acquisition can save you time and money without sacrificing due diligence. By understanding quality of earnings for small business acquisition and mastering DIY quality of earnings analysis, you can make informed decisions about when a full QoE is necessary and when alternatives to QoE for small companies are sufficient. Remember, the goal is to gain a clear, accurate picture of the business’s financial health and potential.

Whether you opt for a formal QoE or simplified QoE for business buyers, always prioritize thorough analysis and critical thinking. With the right approach, you can confidently navigate the financial aspects of your business acquisition and set yourself up for success.

By following the steps and guidelines outlined in this article, you’ll be well-equipped to perform your own quality of earnings for small business acquisition when appropriate, saving valuable resources while still ensuring a sound investment decision.

Always remember that while alternatives to QoE for small companies can be effective, there are situations where professional expertise is invaluable. Trust your judgment, do your homework, and don’t hesitate to seek expert advice when needed.

While DIY quality of earnings analysis can be effective for many small business acquisitions, it’s natural to feel uncertain about tackling this crucial step on your own. If you find yourself lacking confidence in performing a DIY analysis or simply want expert guidance, we’re here to help. Schedule for a free consultation.

More Resources

- Small Business Administration (SBA) – Buying a Business

Link: https://www.sba.gov/business-guide/plan-your-business/buy-existing-business-or-franchise

This official government resource provides valuable information on buying a small business, which aligns well with our topic and adds credibility.

- SCORE – Guide to Buying a Small Business

Link: https://www.score.org/resource/guide-buying-small-business

SCORE is a nonprofit organization that partners with the SBA. This guide offers comprehensive information on small business acquisition, complementing our article’s content.

- International Business Brokers Association (IBBA) – Resources for Buyers

Link: https://www.ibba.org/buyers/

The IBBA is a professional association for business brokers. Their resources for buyers can provide additional insights into the business acquisition process, including financial due diligence.