A classified balance sheet is a financial statement that organizes a company’s assets, liabilities, and equity into distinct categories, providing a more detailed and structured view of its financial position. This comprehensive guide will explore the components, purpose, and importance of a classified balance sheet, as well as how to interpret and analyze it effectively.

Table of Contents

- 1 What is a Classified Balance Sheet?

- 2 Components of a Classified Balance Sheet

- 3 Purpose and Importance of a Classified Balance Sheet

- 4 How to Interpret a Classified Balance Sheet

- 5 Common Misconceptions About Balance Sheets

- 6 The Relationship Between Balance Sheet and Other Financial Statements

- 7 Industry-Specific Considerations

- 8 Challenges in Preparing a Classified Balance Sheet

- 9 The Role of Accounting Standards

- 10 Technology and Balance Sheet Preparation

- 11 The Future of Balance Sheet Reporting

- 12 Conclusion

- 13 Q&A

What is a Classified Balance Sheet?

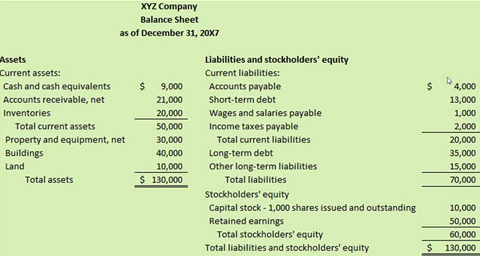

A classified balance sheet is an enhanced version of a standard balance sheet that categorizes assets and liabilities into current and non-current (long-term) sections. This classification helps stakeholders better understand a company’s short-term and long-term financial obligations and resources.

Components of a Classified Balance Sheet

Assets

Assets are typically divided into two main categories:

- Cash and cash equivalents

- Short-term investments

- Accounts receivable

- Inventory

- Prepaid expenses

Non-current Assets:

- Long-term investments

- Property, plant, and equipment

- Intangible assets

- Goodwill

Liabilities

Liabilities are also categorized into current and non-current:

- Accounts payable

- Short-term debt

- Accrued expenses

- Unearned revenue

Non-current Liabilities:

- Long-term debt

- Deferred tax liabilities

- Pension obligations

Equity

The equity section typically includes:

- Common stock

- Preferred stock

- Retained earnings

- Additional paid-in capital

Purpose and Importance of a Classified Balance Sheet

The primary purpose of a classified balance sheet is to provide a more detailed and organized view of a company’s financial position. This classification offers several benefits:

- Improved Readability: By grouping similar items together, the classified balance sheet becomes easier to read and understand.

- Enhanced Analysis: The categorization allows for better analysis of a company’s liquidity, solvency, and overall financial health.

- Comparison: It facilitates easier comparison between different periods and with other companies in the same industry.

- Decision-Making: Investors, creditors, and management can make more informed decisions based on the detailed information provided.

How to Interpret a Classified Balance Sheet

Liquidity Analysis

The current assets and current liabilities sections are crucial for assessing a company’s liquidity. Key ratios derived from these sections include:

- Current Ratio = Current Assets / Current Liabilities

- Quick Ratio = (Current Assets – Inventory) / Current Liabilities

These ratios help determine a company’s ability to meet its short-term obligations.

Solvency Analysis

The non-current sections provide insight into a company’s long-term financial stability. Important ratios include:

- Debt-to-Equity Ratio = Total Liabilities / Total Equity

- Long-term Debt to Equity Ratio = Long-term Debt / Total Equity

These ratios help assess a company’s ability to meet its long-term financial obligations.

Common Misconceptions About Balance Sheets

Book Value vs. Market Value

It’s important to note that the book value of assets on a balance sheet may not always reflect their true market value. For example, a company’s real estate assets might be recorded at historical cost minus depreciation, which could be significantly lower than their current market value.

Intangible Assets

Intangible assets, such as brand value or intellectual property, may not always be fully reflected on the balance sheet due to accounting rules. This can lead to discrepancies between a company’s book value and its market capitalization.

The Relationship Between Balance Sheet and Other Financial Statements

The classified balance sheet is closely linked to other financial statements:

- Income Statement: Net income from the income statement flows into retained earnings on the balance sheet.

- Cash Flow Statement: Changes in cash and cash equivalents on the balance sheet are explained in detail in the cash flow statement.

- Statement of Changes in Equity: This statement provides a detailed breakdown of changes in the equity section of the balance sheet.

Industry-Specific Considerations

Different industries may have unique balance sheet items or classifications:

- Banks: May have a separate category for loans and advances to customers.

- Manufacturing Companies: Often have significant inventory and property, plant, and equipment.

- Tech Companies: May have substantial intangible assets related to intellectual property.

Challenges in Preparing a Classified Balance Sheet

Asset Classification

Determining whether an asset should be classified as current or non-current can sometimes be challenging. For example, a long-term investment nearing maturity might be reclassified as a current asset.

Contingent Liabilities

Deciding whether to include contingent liabilities and how to classify them can be complex and may require professional judgment.

The Role of Accounting Standards

Accounting standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), provide guidelines for preparing classified balance sheets. These standards ensure consistency and comparability across companies and industries.

Technology and Balance Sheet Preparation

Modern accounting software has simplified the process of creating and maintaining classified balance sheets. These tools can automatically categorize transactions and generate financial statements, reducing the potential for human error.

The Future of Balance Sheet Reporting

As business models evolve and new types of assets (such as cryptocurrencies) emerge, accounting standards and balance sheet classifications may need to adapt. There’s ongoing discussion in the accounting community about how to best represent these new asset classes on financial statements.

Conclusion

A classified balance sheet is a powerful tool for understanding a company’s financial position. By organizing assets, liabilities, and equity into meaningful categories, it provides valuable insights for investors, creditors, and management. However, it’s important to remember that the balance sheet is just one piece of the financial puzzle and should be analyzed in conjunction with other financial statements and ratios for a comprehensive view of a company’s financial health.

Q&A

- Q: What is the main difference between a classified and an unclassified balance sheet?

A: The main difference is that a classified balance sheet organizes assets and liabilities into current and non-current categories, while an unclassified balance sheet simply lists all items without this distinction. - Q: How does a classified balance sheet help in financial analysis?

A: A classified balance sheet aids in financial analysis by allowing for easier calculation of liquidity and solvency ratios, providing a clearer picture of a company’s short-term and long-term financial position - Q: Can the classification of items on a balance sheet change over time?

A: Yes, the classification of items can change. For example, a long-term investment nearing maturity might be reclassified from non-current to current assets. - Q: How often should a company prepare a classified balance sheet?

A: Most companies prepare classified balance sheets at least annually, but many public companies produce them quarterly to provide more frequent updates to stakeholders. - Q: Are there any limitations to using a classified balance sheet?

A: While classified balance sheets provide valuable information, they have limitations. They represent a snapshot in time and may not reflect rapid changes in a company’s financial position. Additionally, they may not fully capture the value of intangible assets or contingent liabilities

Searching for reliable bookkeeping services near you in Seattle? Look no further than CentsIQ! We specialize in expert bookkeeping solutions tailored for local businesses. Contact us today to streamline your finances and focus on what you do best.