Table of Contents

Understanding the Classified Balance Sheet

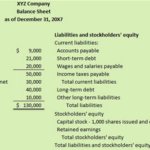

A classified balance sheet is a financial statement that provides a structured overview of a company’s financial position at a specific point in time. It organizes assets, liabilities, and equity into distinct categories, offering a more detailed and informative presentation compared to a general balance sheet

The fundamental components of a classified balance sheet include assets, liabilities, and equity. Assets are typically divided into two categories: current and long-term. Current assets are those expected to be converted into cash or used within one year, such as cash, accounts receivable, and inventory. Long-term assets, on the other hand, include property, equipment, and intangible assets like patents, which are expected to provide value over several years.

Liabilities are also classified into current and long-term categories. Current liabilities, which include accounts payable and short-term loans, are obligations expected to be settled within one year, whereas long-term liabilities, such as bonds payable and long-term leases, extend beyond a year. By segregating these components, a classified balance sheet enables business owners, investors, and creditors to gauge the company’s liquidity—its ability to meet short-term obligations—and solvency, which is the capacity to meet long-term debts.

Overall, understanding the layout and significance of a classified balance sheet is crucial for anyone involved in financial management or investment analysis. This format not only helps in presenting financial data more clearly but also facilitates informed decision-making based on the classification of assets and liabilities.

Gathering Financial Data for Classified Balance Sheet

Preparing a classified balance sheet requires meticulous attention to detail, particularly when it comes to gathering the necessary financial data. The first step in this process is to collect relevant documents that will provide a complete picture of the organization’s financial position. Essential documents include financial statements, such as income statements and previous balance sheets, which will offer valuable insights into historical performance. Additionally, bank statements are crucial, as they reflect current cash balances and transactions that may not yet be recorded in other ledgers.

Another critical component is gathering general ledgers, which will help track all transactions and provide detailed accounts of all assets and liabilities. It is vital to ensure that all information collected is accurate and up-to-date. Inaccuracies in financial data can lead to misguided decisions and misrepresentation of the company’s financial health. To enhance accuracy, cross-reference the information within these documents and rectify any discrepancies before proceeding to the classification stage.

Once the necessary documents are in hand, the next task is to identify and categorize all assets and liabilities. Assets are divided into short-term and long-term classifications. Short-term assets, or current assets, include cash, accounts receivable, and inventory, which are expected to be converted into cash within a year. Conversely, long-term assets, such as property, plant, and equipment, are expected to provide economic benefits beyond a single year. Similarly, liabilities should be classified as current liabilities, such as accounts payable and short-term debt, or long-term liabilities that encompass mortgages and long-term loans. Effectively organizing this data will not only streamline the balance sheet preparation process but also enhance overall financial analysis.

Formatting the Classified Balance Sheet

The correct structuring of a classified balance sheet is crucial for presenting financial information in a logical and easily understandable manner. This form of the balance sheet categorizes assets and liabilities into current and long-term classifications, ensuring better clarity for users of the financial statements. To begin, the balance sheet should be divided into three main sections: Assets, Liabilities, and Equity.

Under the Assets heading, it is advisable to create two subheadings: Current Assets and Long-term Assets. Current Assets typically include cash, accounts receivable, inventory, and other assets expected to be converted into cash within one year. Long-term Assets, on the other hand, encompass investments, property, plant, equipment, and intangible assets such as patents or trademarks. An example format for Current Assets might look like this:

Assets

Current Assets:

Cash

Accounts Receivable

Inventory

Long-term Assets:

Property, Plant, and Equipment

Intangible Assets

Following the Assets section, the Liabilities section should be formatted similarly with Current Liabilities and Long-term Liabilities. Current Liabilities include accounts payable and short-term debts, while Long-term Liabilities might consist of bonds payable and long-term loans. It is recommended to clearly differentiate between these categories for better readability.

Finally, the Equity section is essential for showing the company’s net worth. This segment usually comprises common stock, retained earnings, and additional paid-in capital. Including supplementary notes and disclosures at the end of the balance sheet provides added context to the presented figures, enhancing the document’s effectiveness. Through careful formatting, the classified balance sheet can effectively communicate financial health to interested parties such as investors and stakeholders.

Analyzing the Classified Balance Sheet

Once the classified balance sheet has been meticulously prepared, the next step involves a critical analysis of its components to gauge the company’s financial health and stability. This analysis is essential for stakeholders, such as investors and management, who seek to understand the organization’s financial position. A thorough interpretation of the classified balance sheet can lead to better decision-making based on concrete data.

One of the key metrics to consider is the current ratio, which is calculated by dividing current assets by current liabilities. This ratio provides insight into the company’s ability to meet its short-term obligations. A current ratio greater than one indicates that the company has sufficient assets to cover its liabilities, suggesting good short-term financial health. Conversely, a ratio below one may raise red flags regarding the liquidity position of the organization.

Another crucial ratio to evaluate is the debt-to-equity ratio, which assesses the proportion of debt and equity used to finance the company’s assets. This is calculated by dividing total liabilities by shareholders’ equity. A higher debt-to-equity ratio can indicate a company that is heavily reliant on borrowed funds, which may entail higher financial risk. In contrast, a lower ratio suggests a more conservative approach to financing and may indicate greater financial stability.

Furthermore, analyzing trends over time can provide additional context. By comparing ratios from different reporting periods, stakeholders can identify patterns and make forecasts about future financial performance. This historical perspective is vital in recognizing whether a company’s financial health is improving, stable, or deteriorating. Consequently, the analysis of the classified balance sheet equips stakeholders with vital information to make informed business decisions, ensuring a clearer understanding of potential opportunities or risks in the financial landscape.