If you’re self-employed and considering forming an LLC taxed as an S Corp, you’ve probably heard it can save you money on taxes. But how exactly does it work? Let’s break it down with a real-life example—no jargon, just clear numbers—so you can see how business expenses, salaries, and distributions affect your bottom line.

Table of Contents

Meet Alex: A Self-Employed Consultant

Alex is a freelance consultant who works remotely but occasionally travels for clients. In 2024, they decide to form an LLC and elect S Corp status to reduce their tax bill. Here’s their financial picture:

- Business Revenue: 100,000 (20,000 billed to clients for travel costs).

- Business Expenses: $20,000 spent on travel (reimbursed by clients).

- Salary: $70,000 (paid to Alex as a W-2 employee of their S Corp).

- Distributions: $10,000 (profits left after expenses and salary).

- 401(k) Contributions: $20,000 (from Alex’s salary).

At first glance, Alex thinks they’re walking away with $80,000 in their pocket. But let’s dig into the taxes to see what actually happens.

Step 1: How the S Corp Lowers Taxes

With an S Corp, you split your income into two buckets:

- Salary: Subject to income tax and 15.3% FICA (Social Security + Medicare).

- Distributions: Only subject to income tax (no FICA).

For Alex:

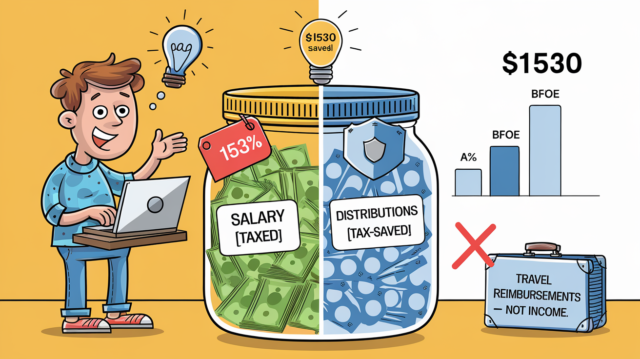

- Salary: $70,000 → taxed fully.

- Distributions: $10,000 → taxed as income but saves 15.3% in FICA.

Key Savings: By taking 10,000as distributions instead of salary, Alex avoids 1,530 in FICA taxes ($10,000 × 15.3%).

Step 2: Business Expenses Aren’t Income (Here’s Why)

Alex’s confusion starts with the $20,000 travel expense. Here’s the truth:

- Clients reimbursed Alex 20,000 for travel → this is part of the 100,000 revenue.

- Alex then spent $20,000 on travel → this is a deductible business expense.

Result: The 20,000cancels out.

Step 3: Calculating Taxes (The Real Numbers)

Let’s break down Alex’s tax burden:

1. FICA Taxes (15.3%)

- Paid only on the $70,000 salary.

- 70,000×15.310,710.

2. Federal & State Income Taxes

- Taxable Wages: 70,000salary–20,000 401(k) contribution = $50,000.

- Taxable Distributions: $10,000.

- Total Taxable Income: 50,000+10,000 = $60,000.

Deduction Alert: Alex can deduct half of their FICA taxes (5,355).

What Alex Actually Takes Home

- Pre-Tax Cash:

- Salary: $70,000

- Distributions: $10,000

- Minus 401(k): $20,000

- Total: 10,000 – 20,000=60,000.

- Post-Tax Cash:

- 60,000–24,371 taxes = $35,629.

- Retirement Savings: $20,000 in their 401(k).

Total Compensation: 35,629(cash)+20,000 (retirement) = $55,629.

Myth Busted: Alex initially thought they kept 88% of their income (80,000). But after fixing the travel expense mistake and properly deducting taxes, their take-home is 59% of their pre-tax cash (60,000).

Common Mistakes to Avoid

- Treating Reimbursements as Income: Client reimbursements offset expenses—they don’t pad your bank account.

- Ignoring Retirement Contributions: 401(k) contributions lower taxable income. Max them out!

- Setting an Unreasonable Salary: If Alex paid themselves a 30,000 salary and50,000 in distributions, the IRS would red-flag it.

Why This Matters for You

If you’re self-employed, an S Corp can save you thousands in taxes—but only if you:

- Pay yourself a reasonable salary (research your industry’s standards).

- Track business expenses meticulously.

- Work with a CPA to avoid IRS issues.

Final Takeaway

The S Corp structure isn’t a magic trick, but it’s a powerful tool when used correctly. For Alex, it saved $1,530 in FICA taxes on distributions and lowered their taxable income through deductions. Just remember: taxes are inevitable, but overpaying isn’t.

Need help? Contact us.