While browsing BizBuySell, you found an opportunity: someone is selling their business for cash in a sector that interests you. But buying a cash business can be an enticing opportunity for entrepreneurs looking to enter the world of small business ownership. However, it comes with unique challenges that require careful consideration and thorough due diligence. This guide will explore the key aspects of buying a cash business and provide strategies to ensure a successful acquisition.

Table of Contents

- 1 Understanding the Appeal and Risks of Buying a Cash Business

- 2 Key Steps in Evaluating a Cash Business for Purchase

- 3 Red Flags to Watch For When Buying a Cash Business

- 4 Alternative Valuation Methods for Cash Businesses

- 5 Legal and Regulatory Compliance

- 6 Financing Considerations for Buying a Cash Business

- 7 Conclusion: Making an Informed Decision

- 8 Ready to take your financial reporting to the next level?

Understanding the Appeal and Risks of Buying a Cash Business

Cash businesses often attract potential buyers due to their perceived simplicity and potential for immediate income. When considering buying a cash business, it’s crucial to understand both the advantages and the risks involved: Advantages:

- Immediate cash flow

- Established customer base

- Potential for higher profit margins

Risks:

- Difficulty verifying financial claims

- Potential tax compliance issues

- Challenges in obtaining financing

Key Steps in Evaluating a Cash Business for Purchase

When buying a cash business, thorough due diligence is essential. Here are critical steps to take:

- Request Financial Documentation

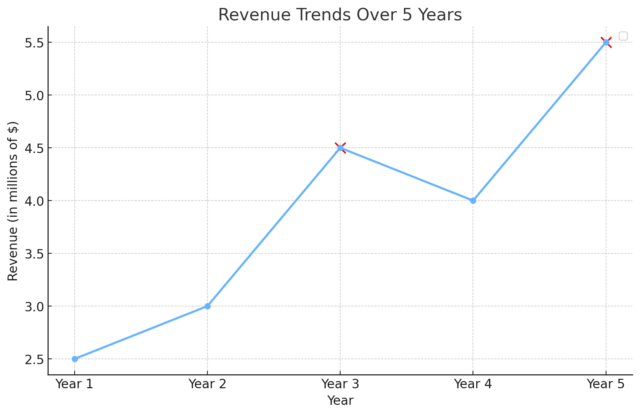

When buying a cash business, always request 3-5 years of tax returns and financial statements. These documents provide a baseline for verifying the seller’s claims about the business’s performance. - Verify Revenue Claims

Don’t rely solely on the seller’s word when buying a cash business. Implement strategies to independently verify revenue claims:- Conduct on-site observations of customer traffic over multiple days

- Create your own profit and loss (P&L) projections based on observed activity

- Request access to security footage to estimate sales volume

- Engage Professional Help

When buying a cash business, it’s wise to enlist the help of professionals:- Have a Certified Public Accountant (CPA) review the books and compare them against bank deposits and withdrawals

- Consult with a business broker or M&A specialist for guidance

- Engage a lawyer to review all contracts and agreements

- Assess Physical Assets

Since buying a cash business often includes physical assets, consider:- Getting professional appraisals for the building, land, and equipment

- Making an offer based on physical assets if financials are unclear

- Understand the True Value

Remember that when buying a cash business, its true value is typically based on documented profitability. Be cautious of sellers who may have underreported income to avoid taxes, as this can significantly impact the actual value and legality of the business.

Red Flags to Watch For When Buying a Cash Business

Be alert to these warning signs when considering buying a cash business:

- Lack of proper financial records or tax returns

- Reluctance to provide documentation

- Significant discrepancies between claimed and documented revenue

- Hints of unreported income or tax evasion

Alternative Valuation Methods for Cash Businesses

If financial records are inadequate when buying a cash business, consider these alternative approaches:

- Estimate value based on physical assets (building, land, inventory, equipment)

- Use industry-standard multiples of verifiable revenue or profits

- Consider the potential for future earnings based on your observations and market analysis

Legal and Regulatory Compliance

Ensure the business is compliant with all relevant laws and regulations:

- Verify all necessary licenses and permits are in place and transferable

- Check for any pending legal issues or regulatory violations

- Understand the implications of taking over a cash-based business, especially regarding tax compliance

Financing Considerations for Buying a Cash Business

When seeking financing for buying a cash business:

- Be prepared for additional scrutiny from lenders due to the cash-based nature of the business

- Have a solid business plan that addresses how you’ll manage and grow the business

- Consider seller financing as an option, which can align the seller’s interests with the future success of the business

Conclusion: Making an Informed Decision

Buying a cash business presents unique challenges and opportunities. While the potential for a good deal exists, it’s crucial to approach the transaction with caution and thoroughness. If the seller cannot provide satisfactory financial documentation or if you encounter significant red flags during your due diligence, it may be wise to walk away from the deal or significantly adjust your offer to account for the increased risk. Remember, the goal of due diligence when buying a cash business is not just to verify the seller’s claims but to give you a comprehensive understanding of the business you’re considering purchasing.

This knowledge will be invaluable in making an informed decision and, if you proceed, in successfully running the business post-acquisition. By following these guidelines and conducting thorough due diligence, you can navigate the complexities of buying a cash business and increase your chances of a successful acquisition.

Ready to take your financial reporting to the next level?

Centsiq offers top-notch Quality of Earnings (QoE) services that go beyond basic bookkeeping. Let our experts help you gain deeper insights into your business’s financial health. Contact Centsiq today for a consultation and discover how we can elevate your financial management game!