Are you part of a nonprofit organization considering leasing an electric vehicle (EV)? You might be wondering about the potential tax benefits and how they apply to your unique situation. In this guide, we’ll dive deep into the world of EV tax credits for nonprofit leases, breaking down the complexities and providing you with practical, actionable information.

Table of Contents

- 1

- 2 The Unique Position of Nonprofits

- 3 Can Nonprofits Benefit from EV Tax Credits?

- 4 The Leasing Advantage for Nonprofits

- 5 How the Process Works

- 6 Maximizing Tax Credit for Nonprofit Leases

- 7 Real-World Example

- 8 Potential Pitfalls to Watch Out For

- 9 FAQs About EV Tax Credits for Nonprofit Leases

- 10 The Future of EV Tax Credits for Nonprofits

- 11 Making the Decision: Is an EV Lease Right for Your Nonprofit?

- 12 Steps to Take Now

- 13 Conclusion: Embracing the Electric Future

- 14 References:

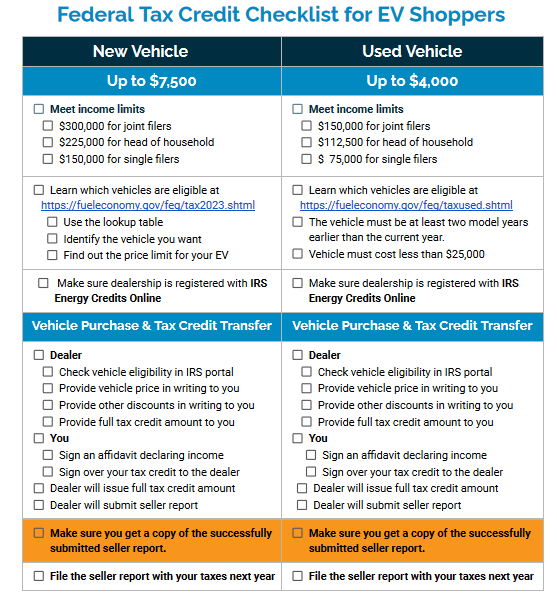

Before we delve into the specifics for nonprofits, let’s start with the fundamentals. The federal government offers tax credits to incentivize the adoption of electric vehicles. These credits can be substantial, potentially reaching up to $7,500 for qualifying vehicles. But how does this work when a nonprofit organization is involved?

The Unique Position of Nonprofits

Nonprofits occupy a special place in the tax world. Unlike for-profit businesses, they don’t typically pay federal income taxes. This unique status creates some interesting wrinkles when it comes to EV tax credits. After all, how can you claim a credit against taxes you don’t owe?

Can Nonprofits Benefit from EV Tax Credits?

The short answer is yes, but it’s not as straightforward as it is for individuals or for-profit businesses. Nonprofits can indeed benefit from EV tax credits, but the mechanism is a bit different. Here’s how it generally works:

- Direct Purchase: If a nonprofit purchases an EV outright, they typically can’t claim the tax credit directly since they don’t have a tax liability.

- Leasing: This is where things get interesting. When a nonprofit leases an EV, the leasing company (usually a for-profit entity) can claim the tax credit.

- Pass-Through Benefits: The leasing company can then pass on some or all of the savings to the nonprofit in the form of reduced lease payments.

The Leasing Advantage for Nonprofits

Leasing an EV can be a smart move for nonprofits looking to benefit from tax credits indirectly. Here’s why:

- Lower Upfront Costs: Leasing typically requires less money upfront compared to purchasing.

- Indirect Tax Credit Benefits: The lessor can pass on savings from the tax credit.

- Flexibility: At the end of the lease, you can choose to upgrade to a newer, more efficient model.

How the Process Works

Let’s walk through a typical scenario of how a nonprofit might benefit from EV tax credits through leasing:

- Choose Your EV: Select an eligible electric vehicle that meets your organization’s needs.

- Find a Leasing Company: Look for a leasing company experienced in working with nonprofits and EV tax credits.

- Negotiate the Lease: This is crucial. Discuss how the tax credit will be factored into your lease payments.

- Sign the Lease: The leasing company will claim the tax credit.

- Enjoy Lower Payments: Your monthly lease payments should reflect the passed-on savings from the tax credit.

Maximizing Tax Credit for Nonprofit Leases

To get the most out of EV tax credits for your nonprofit lease, consider these tips:

- Do Your Homework: Research which EVs qualify for the full credit.

- Shop Around: Different leasing companies may offer varying levels of savings.

- Negotiate: Don’t be afraid to ask how much of the tax credit savings will be passed on to you.

- Read the Fine Print: Understand all terms of the lease agreement.

Real-World Example

Let’s look at a hypothetical scenario to illustrate how this might work in practice:

Nonprofit Organization A decides to lease an electric vehicle with a retail price of $40,000. The vehicle qualifies for the full $7,500 federal tax credit. The leasing company claims this credit and agrees to pass on 80% of the savings to the nonprofit. This results in a reduction of $6,000 in the overall cost of the lease, which is then spread out over the lease term, lowering monthly payments.

Potential Pitfalls to Watch Out For

While the benefits can be significant, there are some potential issues to be aware of:

- Not All Savings Passed On: Some leasing companies may not pass on the full amount of the tax credit savings.

- Eligibility Changes: Tax laws and eligibility requirements can change, potentially affecting long-term leases.

- Limited Vehicle Selection: Not all EVs qualify for the full tax credit, which may limit your options.

FAQs About EV Tax Credits for Nonprofit Leases

To help clarify some common questions, let’s address a few FAQs:

Q: Can our nonprofit claim the EV tax credit directly?

A: Generally, no. Nonprofits typically can’t claim the credit directly due to their tax-exempt status.

Q: How much of the tax credit savings can we expect to see in our lease?

A: This varies by leasing company and negotiation. It could range from a small percentage to the full amount of the credit.

Q: Do all electric vehicles qualify for the tax credit?

A: No, eligibility depends on factors like battery capacity and the manufacturer’s sales volume.

Q: What happens if tax laws change during our lease term?

A: Your existing lease should not be affected, but future leases might be impacted by new regulations.

The Future of EV Tax Credits for Nonprofits

As we look ahead, it’s important to consider the evolving landscape of EV incentives:

- Changing Regulations: Keep an eye on potential changes to tax laws that might affect EV credits.

- State and Local Incentives: Don’t forget to explore additional incentives offered by your state or local government.

- Growing EV Market: As more EVs enter the market, we may see changes in how credits are applied and distributed.

Making the Decision: Is an EV Lease Right for Your Nonprofit?

Deciding whether to lease an EV for your nonprofit involves weighing several factors:

- Financial Considerations:

- Upfront costs vs. long-term savings

- Budget impact of monthly lease payments

- Potential for reduced maintenance and fuel costs

- Operational Needs:

- Daily mileage requirements

- Charging infrastructure availability

- Type of activities the vehicle will be used for

- Environmental Impact:

- Alignment with your organization’s mission and values

- Potential for positive public perception

- Long-Term Strategy:

- Future fleet needs

- Technological advancements in the EV market

Steps to Take Now

If you’re considering leasing an EV for your nonprofit, here are some actionable steps to take:

- Assess Your Needs: Evaluate your organization’s vehicle requirements.

- Research Eligible Vehicles: Look into which EVs qualify for the tax credit.

- Contact Leasing Companies: Reach out to multiple companies for quotes and information.

- Consult Your Financial Advisor: Discuss the financial implications with your organization’s financial expert.

- Plan for Charging: Consider where and how you’ll charge the vehicle.

Conclusion: Embracing the Electric Future

Leasing an EV can be an excellent way for nonprofits to benefit indirectly from tax credits while also contributing to environmental sustainability. By understanding the nuances of EV tax credits for nonprofit leases, you can make an informed decision that benefits both your organization and the planet. Remember, the world of EV incentives is constantly evolving. Stay informed about changes in tax laws and new incentives that might become available.

With careful planning and negotiation, your nonprofit can ride the wave of the electric vehicle revolution while enjoying significant financial benefits. Are you ready to take the next step towards electrifying your nonprofit’s fleet? Start by reaching out to EV leasing specialists who understand the unique needs of nonprofit organizations. Your journey towards a greener, more cost-effective future starts now!