When facing QuickBooks Online accrual basis cleanup with numerous outstanding checks, start by creating a comprehensive list of all uncleared transactions, use systematic color-coding or sorting methods to track timing differences, and focus on matching transaction dates to when expenses were actually incurred rather than when checks were cashed. The key is understanding that in accrual accounting, expenses should be recorded when the obligation occurs, not when payment is made.

As a professional bookkeeper, I frequently encounter businesses struggling with QuickBooks Online cleanup projects, particularly when transitioning from cash-based to accrual-based accounting methods. This challenge becomes especially complex when dealing with companies that process numerous paper checks, creating significant timing differences between recorded transactions and actual bank clearances.

Table of Contents

- 1 Understanding the Core Challenge of QuickBooks Online Accrual Basis Cleanup

- 2 The Accrual vs. Cash Basis Distinction

- 3 Systematic Approach to Outstanding Check Management

- 4 Best Practices for Accrual Cleanup Projects

- 5 Advanced Techniques for Complex Situations

- 6 When to Seek Professional Help

- 7 Conclusion: Your Path to Clean, Accurate Books

Understanding the Core Challenge of QuickBooks Online Accrual Basis Cleanup

The fundamental issue many businesses face during accrual basis cleanup stems from improper transaction recording methods. When previous bookkeepers record check payments as direct bank withdrawals instead of properly accounting for the timing differences inherent in accrual accounting, it creates reconciliation nightmares that can persist for months.

In accrual accounting, the timing of when a check is written, when an expense is incurred, and when the check actually clears the bank are three distinct events that must be properly managed. This becomes particularly problematic for businesses where elderly family members or non-accounting staff handle bill payments, often resulting in extended periods between check writing and check cashing

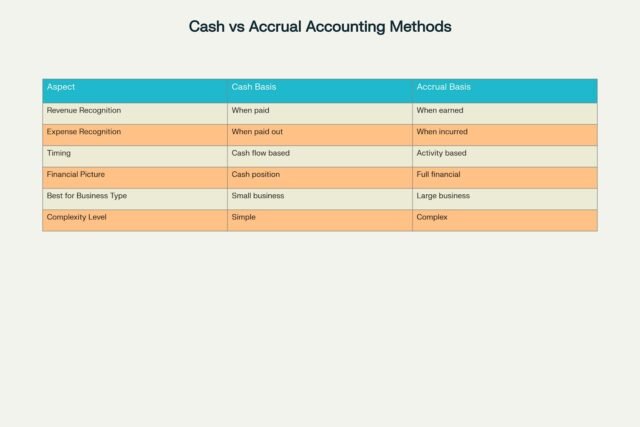

Cash vs Accrual Accounting Methods Comparison

The Accrual vs. Cash Basis Distinction

Understanding the fundamental differences between accounting methods is crucial for successful cleanup projects. In cash basis accounting, transactions are recorded when money actually changes hands, while accrual basis records transactions when the economic activity occurs, regardless of payment timing.

For businesses using accrual accounting, expenses must be recorded on the date the service was provided or the obligation was incurred, not when the check was written or cashed. This principle creates the complexity that many bookkeepers struggle with during cleanup projects, especially when dealing with substantial numbers of outstanding checks.

Systematic Approach to Outstanding Check Management

The most effective strategy for handling outstanding checks in accrual basis cleanup involves creating a comprehensive tracking system. Start by generating a complete list of all checks that have been recorded in QuickBooks Online but haven’t yet cleared the bank.

Organize this information by implementing a color-coding system or detailed spreadsheet that tracks check numbers, dates written, amounts, payees, and current status. This method allows you to systematically work through discrepancies while maintaining clear documentation of your progress.

When reconciling, sort your transactions by different criteria – first by check numbers if your bank statements include them, then by amount to handle credits and deposits systematically. This approach prevents overlooking transactions and ensures comprehensive coverage of all outstanding items.

Best Practices for Accrual Cleanup Projects

Successful QuickBooks Online cleanup requires following established protocols that ensure accuracy and completeness. Begin every project by backing up your client’s data and gathering all necessary financial documents, including bank statements, credit card statements, invoices, and previous financial reports.

Focus on the bank reconciliation as your primary starting point, as this process reveals the scope of timing differences and outstanding transactions that need addressing. Remember that in accrual accounting, the date when expenses are incurred takes precedence over payment dates, which means you may need to adjust transaction dates to reflect when services were actually received or obligations were created.

Advanced Techniques for Complex Situations

For businesses with extensive outstanding check issues, consider implementing a check clearing account system. This approach involves creating a separate account to track checks that have been written but not yet cashed, providing clearer visibility into actual cash positions while maintaining proper accrual accounting principles.

When dealing with checks that have been outstanding for extended periods, evaluate whether they represent legitimate business expenses or require writeoffs. Checks outstanding for more than six months may need special attention, as they could represent unclaimed property issues or simple accounting errors.

Technology Solutions and Efficiency Improvements

Modern QuickBooks Online includes several features that can streamline the cleanup process. Utilize the platform’s bank feed connectivity to automatically import transactions, then focus your efforts on categorizing and properly dating entries rather than manual data entry.

Consider leveraging QBO’s built-in reconciliation tools, which can automatically match transactions and highlight discrepancies. However, remember that these automated features still require careful review to ensure proper accrual accounting treatment.

When to Seek Professional Help

QuickBooks Online cleanup projects can quickly become overwhelming, especially for businesses attempting to handle complex accrual accounting issues without professional expertise. Signs that professional bookkeeping assistance is needed include consistently failing reconciliations, unexplained balance sheet discrepancies, or cleanup projects that have been ongoing for more than 60 days.

Professional bookkeepers bring specialized knowledge of QuickBooks Online’s advanced features, understanding of accrual accounting principles, and systematic approaches that ensure accurate, compliant financial records. They can also identify and correct underlying procedural issues that prevent future cleanup requirements.

Conclusion: Your Path to Clean, Accurate Books

Successfully managing QuickBooks Online accrual basis cleanup requires systematic approach, proper understanding of accounting principles, and often professional expertise. The investment in proper cleanup pays dividends through accurate financial reporting, tax compliance, and business decision-making capabilities.

As a professional bookkeeper specializing in QuickBooks Online cleanup projects, I help businesses navigate these complex challenges while establishing systems that prevent future issues. If your business is struggling with accrual accounting cleanup, outstanding check reconciliation, or any other QuickBooks Online challenges, professional assistance can save time, prevent costly errors, and provide peace of mind that your financial records accurately reflect your business performance.

Don’t let messy books hold your business back. Contact a qualified bookkeeping professional today to discuss your cleanup needs and develop a plan for maintaining accurate, reliable financial records that support your business growth and success.

Contact us at 425-465-8239 for help.