A seasoned CFO recently shared his frustration: His company had chosen an S-Corp structure to save on taxes, only to find itself trapped in a rigid system that still left them overpaying. “We split profits evenly at around $80k each, but the ‘reasonable salary’ requirements eat into our flexibility,” he explained. This story isn’t unique—it’s a symptom of a systemic issue plaguing businesses that default to S-Corps without weighing alternatives like multi-member LLCs. Let’s unpack why the S-Corp hype often backfires and how LLCs unlock superior tax efficiency, flexibility, and growth potential.

Table of Contents

The S-Corp Trap: 4 Hidden Costs That Erode Your Profits

🔹 Rigid Ownership Rules

S-Corps come with strict limitations:

- Only 100 shareholders allowed.

- Shareholders must be U.S. citizens or residents—no foreign investors.

- Entities like trusts or other corporations can’t own shares.

Example: A tech startup with three co-founders wanted to bring in a Singapore-based angel investor. Their S-Corp structure blocked this move, forcing them to either abandon the investment or dissolve the S-Corp entirely.

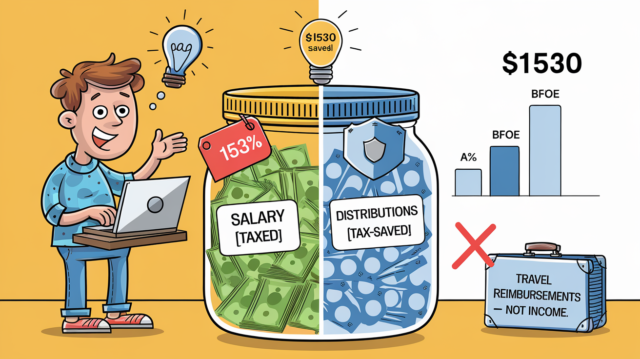

🔹 Forced Salaries That Inflate Your Tax Bill

S-Corps require owner-employees to take “reasonable” W-2 salaries before profit distributions. The IRS scrutinizes these salaries, and underpaying can trigger audits.

Case Study: A marketing agency with $500k in net income paid its two owners $120k each in salaries (deemed “reasonable” by their CPA). The remaining $260k was distributed as profits, but the owners still paid 15.3% self-employment tax on salaries plus income tax on distributions. Total tax rate: ~40%.

🔹 Profit Distributions Locked to Ownership Percentages

S-Corp profits must be distributed pro rata. If you own 30% of shares, you get 30% of profits—no exceptions, even if one owner contributed 70% of that year’s revenue.

Example: A construction firm had two partners: One brought in 80% of clients, while the other handled operations. The S-Corp structure forced a 50/50 split, creating resentment and stifling incentive for the high performer.

🔹 No Strategic Tax Layering

S-Corps can’t be owned by other entities, blocking advanced strategies like:

- Holding companies to isolate liabilities.

- Family trusts for estate planning.

- Subsidiaries to compartmentalize risk.

The Multi-Member LLC Advantage: Flexibility, Protection, and Tax Mastery

✅ Ownership Without Borders

Multi-member LLCs allow:

- Unlimited members (investors, partners, foreign entities).

- Hybrid structures (e.g., a parent LLC owning subsidiaries).

- Trusts or corporations as members for estate planning or liability shielding.

Example: A real estate LLC pooled investments from 15 high-net-worth individuals across four countries, something impossible with an S-Corp.

✅ Profit Distributions Tailored to Performance

LLC operating agreements let you distribute profits however you want:

- 70/30 splits favoring a key contributor.

- Bonuses for hitting revenue milestones.

- Reinvestment reserves for growth.

Case Study: A consulting LLC with four partners allocated profits as follows: 40% to the lead strategist, 30% to the operations head, and 15% each to junior partners. This rewarded merit without IRS pushback.

✅ Zero Forced Salaries

LLC owners can take:

- Guaranteed payments (similar to salaries but more flexible).

- Distributions taxed only as income, avoiding the 15.3% self-employment tax on salaries.

Tax Savings Example: An LLC with $300k net income could distribute $250k as profits (taxed at ~25% income tax) and $50k as guaranteed payments (subject to self-employment tax). Total tax: ~$78k. An S-Corp with a $100k “reasonable salary” would pay ~$15k in payroll taxes plus income tax on the remaining $200k, totaling ~$90k—a $12k difference.

✅ Multi-Layered Asset Protection

LLCs can “stack” structures like:

- Holding LLCs to own intellectual property or equipment.

- Operating LLCs to manage day-to-day activities.

- Trusts to shield assets from lawsuits or divorces.

Example: A medical practice uses a holding LLC to own its $2M office building and a separate operating LLC for patient services. If sued, the office building is legally isolated.

Real-World Scenarios: When Multi-Member LLCs Outperform S-Corps

🏢 Scenario 1: Scaling a Startup

A SaaS startup plans to raise venture capital and expand globally.

- S-Corp Roadblock: Can’t accept foreign investors or corporate VC firms.

- Multi-Member LLC Solution: Converts to a multi-member LLC, securing $2M from a mix of U.S. and international investors.

🏭 Scenario 2: Family-Owned Manufacturing Business

A father wants his daughter to inherit the business while minimizing estate taxes.

- S-Corp Roadblock: Shares can’t be placed in a trust without dissolving the S-Corp.

- Multi-Member LLC Solution: Transfers ownership to a grantor trust, reducing estate taxes and keeping control within the family.

🏦 Scenario 3: Real Estate Investors

A group buys a $5M apartment complex.

- S-Corp Roadblock: Pro rata distributions prevent them from rewarding the member who secured the deal.

- Multi-Member LLC Solution: Allocate 25% of profits to the deal-sourcing member, with the rest split equally.

The Bottom Line: Is Your Structure Working for You—or Against You?

The CFO who sparked this conversation learned the hard way: compliance doesn’t equal optimization. While S-Corps work for simple, small businesses with static ownership, multi-member LLCs offer a dynamic toolkit for growth-focused companies.

Before renewing your S-Corp election, ask:

- Do we plan to bring in foreign investors or trusts?

- Could uneven profit splits incentivize key players?

- Would layering entities protect our assets?

As one tax attorney put it: “LLCs are the Swiss Army knife of business structures—designed for the real-world messiness of entrepreneurship.” Your business isn’t a one-size-fits-all entity. Why should your structure be?

You didn’t start your business to spend nights categorizing expenses or arguing with the IRS. Yet here you are: drowning in receipts, second-guessing payroll taxes, and wondering if your “tax-saving” S-Corp structure is actually costing you more.

Here’s the truth:

- 82% of small businesses overpay taxes due to bookkeeping errors.

- Owners waste 120+ hours annually on financial admin—time that could fuel growth.

- Generic accounting software can’t spot hidden deductions or optimize your structure.

CentsIQ flips the script. We’re not just bookkeepers—we’re your profit-protection partners.