If you’re asking this question, you’re already ahead of most owners. A financial review is the easiest way to spot leaks, improve cash flow, and make confident decisions—without hiring a full-time finance team. At CentsIQ®, we combine approachable bookkeeping with advanced analytics to turn your numbers into clear actions.

TL;DR: Yes—financial reviews pay for themselves by catching errors early, improving cash flow visibility, and surfacing profitable next steps. Scroll for charts, timelines, and FAQs.

Table of Contents

- 1 What Is a Financial Review?

- 2 Why It’s Worth It (With Data)

- 3 What’s the Cost of Not Reviewing?

- 4 How Often Should I Do a Financial Review?

- 5 What You’ll Get from a CentsIQ Review

- 6 Our 5‑Step Process

- 7 QuickBooks® Migration & Ongoing Support

- 8 Financial Reporting—Cadence & Customization

- 9 Fractional CFO: Strategy on Demand

- 10 Do I Need Cleanup?

- 11 Who We Serve (Seattle Area)

- 12 Transparent Investment

- 13 Frequently Asked Questions (FAQs)

- 13.1 Is a financial review worth it for my small business?

- 13.2 How would a financial review benefit my business?

- 13.3 Can you help migrate from another accounting platform to QuickBooks?

- 13.4 How can your QuickBooks consulting improve our reporting?

- 13.5 How often will I receive financial reports?

- 13.6 Which financial reports will I get?

- 13.7 Do you provide ongoing QuickBooks support?

- 13.8 Can you fix QuickBooks errors and sync issues?

- 13.9 What does a Fractional CFO do?

- 13.10 I already have QuickBooks. Do I still need a ProAdvisor?

- 13.11 How long will it take to clean up my books?

- 13.12 How do I know if my books need cleanup?

- 13.13 How frequently will you update our financial records?

- 13.14 What bookkeeping services do you offer?

What Is a Financial Review?

A CentsIQ financial review is a structured, light‑lift assessment of your books and operations. We focus on:

- Cash flow trends and working capital

- Revenue quality and margin drivers

- Expense leak detection and vendor analysis

- Balance‑sheet health (aging, accruals, liabilities)

- Forecast & tax readiness

- Quick wins + 90‑day action plan

Deliverables: executive summary, KPI snapshot, prioritized fixes, and a roadmap you can implement with or without us.

Why It’s Worth It (With Data)

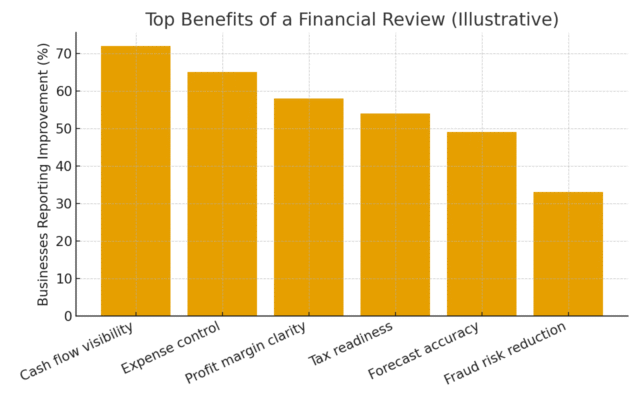

Figure: Top benefits reported by small businesses (illustrative).

- Visibility improves cash run‑way planning and owner peace of mind.

- Expense control finds duplicate subscriptions, over‑billing, and pricing gaps.

- Margin clarity highlights profitable products, services, or routes.

- Tax readiness prevents last‑minute scrambles and penalties.

- Forecast accuracy supports hiring, inventory, and growth decisions.

What’s the Cost of Not Reviewing?

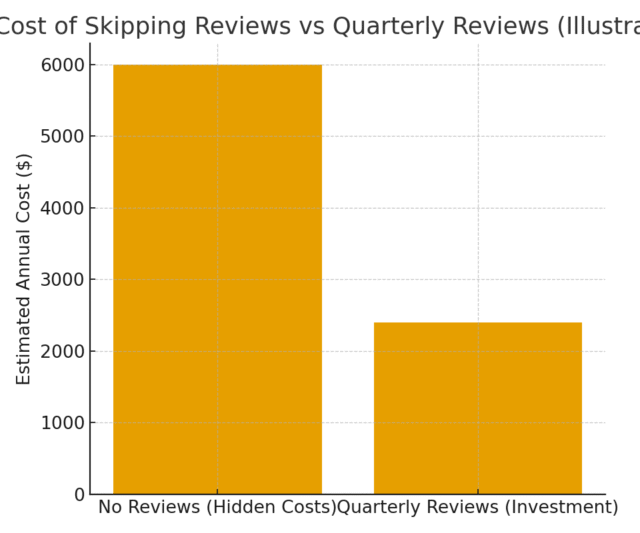

Figure: Illustrative annual comparison—actuals vary by business size and complexity.

Hidden costs often exceed the investment in quarterly reviews. Typical sources: missed vendor credits, mis‑categorized expenses, late fees, and unbilled work.

How Often Should I Do a Financial Review?

Most owners choose:

- Monthly when growing quickly or managing inventory/payroll complexities.

- Quarterly for steady‑state operations.

- Before key events: financing, tax season, expansion, or software migrations.

What You’ll Get from a CentsIQ Review

- Clean KPI dashboard (cash conversion cycle, gross margin, AR/AP aging)

- “Fix‑first” list (high‑ROI cleanups and automations)

- Forecast & budget template tailored to your model

- Tax‑readiness checklist and documentation gaps

- Optional help to implement changes (bookkeeping, analytics, or CFO support)

Our 5‑Step Process

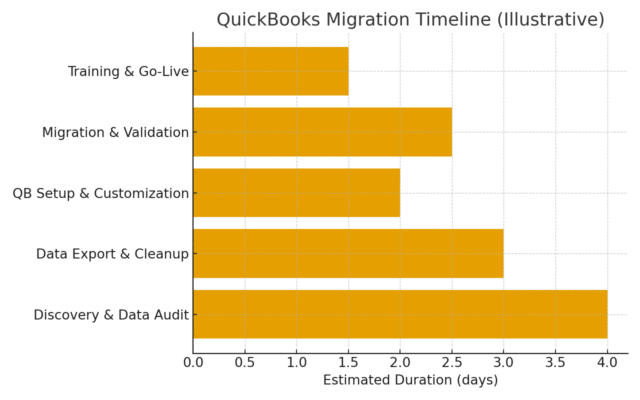

Figure: Sample timeline we use for migrations and deeper cleanups.

- Discovery & Data Audit — We review your chart of accounts, bank feeds, and prior filings.

- Data Export & Cleanup — Fix duplicates, categorize backlogs, and normalize vendors/items.

- Setup & Customization — Tighten workflows, classes/locations, and reporting packages.

- Validation — Reconcile, test reports, and verify opening balances.

- Training & Go‑Live — Owner/staff coaching and a 30‑day check‑in.

QuickBooks® Migration & Ongoing Support

Already on another system? We provide secure QuickBooks migration and ongoing support so your reports stay accurate as you grow. Our certified team can:

- Transfer historical data properly (no broken beginnings)

- Build custom reports and memorize them for one‑click use

- Automate recurring KPIs and alerting

- Troubleshoot errors and sync issues quickly

Have QuickBooks already? A CentsIQ ProAdvisor tunes your setup to avoid clutter, automate the boring stuff, and surface insights you can act on.

Financial Reporting—Cadence & Customization

Whether you need reporting monthly, quarterly, or annually, we tailor packages that include:

- Income statement, balance sheet, cash flow

- Rolling 12‑month trends and cohort views

- Job/product/customer profitability

- Budget vs actuals with variance commentary

We also train your team to interpret the metrics so you aren’t stuck staring at spreadsheets.

Fractional CFO: Strategy on Demand

Need senior finance without a full‑time salary? CentsIQ’s Fractional CFO service helps you:

- Clarify strategy and model scenarios

- Improve margins and pricing

- Build lender‑ready forecasts and board updates

- Make confident, data‑driven decisions

Do I Need Cleanup?

Signs you do: bank reconciliations lag, undeposited funds linger, duplicate entries, or reports that never match your gut. We perform catch‑up & cleanup to put your books back on solid ground, then keep them there.

Who We Serve (Seattle Area)

Based in Seattle, we work with service businesses, e‑commerce, trades, professional services, and light manufacturing across Seattle, Bellevue, Redmond, Kirkland, Tacoma, and Everett (remote available nationwide).

Transparent Investment

Pricing scales with complexity and transaction volume. Most owners start with a fixed‑fee review; ongoing options include monthly bookkeeping, quarterly reviews, or fractional CFO packages. Get a custom quote in minutes.

Ready to see exactly where money is leaking—and how to grow profits?

Book a free 20‑minute consult: Contact@CentsIQ.com · (425) 465‑8239

Frequently Asked Questions (FAQs)

Is a financial review worth it for my small business?

Absolutely. Even lean teams benefit from clear visibility into cash flow, margins, and risks. CentsIQ reviews catch small issues before they become expensive problems and give you a prioritized action plan.

How would a financial review benefit my business?

Think of it as a health check for your finances. We pinpoint what’s working, where money is leaking, and which moves will create the biggest lift. Expect clarity on cash flow, profitability, and tax readiness, plus next steps.

Can you help migrate from another accounting platform to QuickBooks?

Yes. Our Seattle‑based team handles secure migrations—data audit, cleanup, setup, validation, and training—so you get accurate historicals and reliable reports on day one.

How can your QuickBooks consulting improve our reporting?

We customize your chart of accounts and reporting packages, automate key metrics, and train your team to read the numbers. You’ll spend less time exporting and more time deciding.

How often will I receive financial reports?

We tailor cadence to your needs—monthly, quarterly, or annually—with clear commentary so you always know what changed and why.

Which financial reports will I get?

Income statement, balance sheet, and cash flow are standard. We add KPI dashboards, rolling trends, and profitability views by job/product/customer as needed.

Do you provide ongoing QuickBooks support?

Yes. From troubleshooting to new features and integrations, we keep your system running smoothly.

Can you fix QuickBooks errors and sync issues?

Absolutely. We diagnose the root cause, resolve the error, and harden the workflow so it doesn’t return.

What does a Fractional CFO do?

A CentsIQ Fractional CFO translates numbers into strategy—clarifying plans, modeling scenarios, improving margins, and preparing you for lenders, investors, or expansion.

I already have QuickBooks. Do I still need a ProAdvisor?

Yes if you want it set up right—clean workflows, automation, and decision‑ready reporting. A CentsIQ ProAdvisor ensures you’re using QuickBooks to its full potential.

How long will it take to clean up my books?

It depends on volume and complexity. After a quick review, we provide a clear timeline and fixed scope so you know exactly what to expect.

How do I know if my books need cleanup?

Look for backlogs, unreconciled accounts, or reports that don’t align with reality. We’ll confirm with a fast diagnostic and a remediation plan.

How frequently will you update our financial records?

Most clients choose weekly or monthly updates; we tailor to your needs.

What bookkeeping services do you offer?

A/R & A/P, bank and credit‑card reconciliations, payroll coordination, financial reporting, and fractional CFO support—plus analytics that make decisions easier.